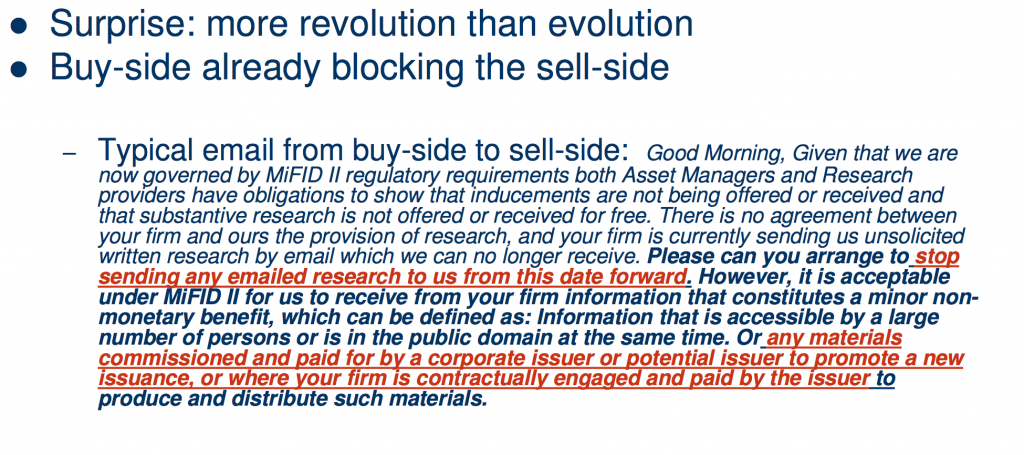

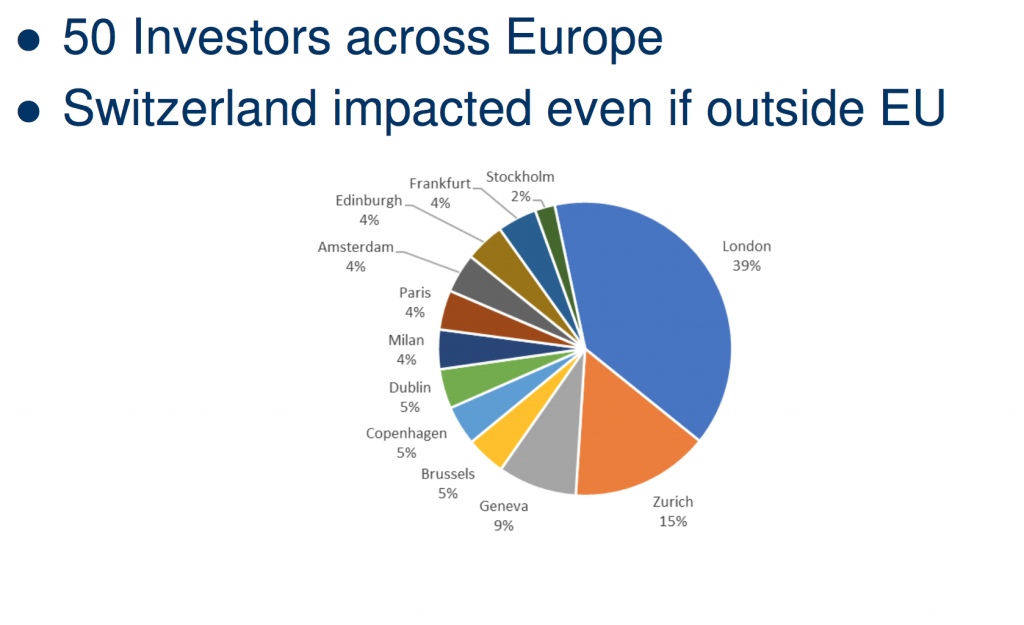

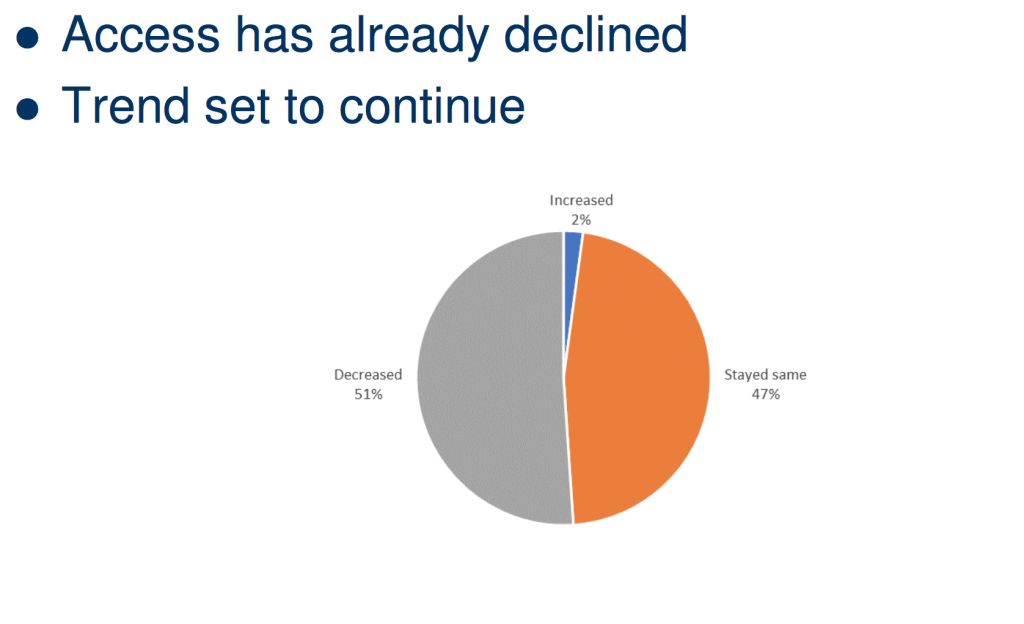

- Access has been negatively affected

- Investors have already reduced the number of brokers they are dealing with for both equity research and Corporate Access

- Cutbacks in research providers is already leading to restricted access to conferences and non-deal roadshows

- Price discovery for research is evolving quickly

- The risks of companies and investors ‘missing’ each other during roadshows has increased

- Interesting (and worrying) divergence appearing between the communication lines issuers-to-shareholders and issuers-to-non shareholders

- Buy-side is contacting more companies directly and would like company IR teams to also do more themselves

- Investors are strongly in favor of an independent model for providing Corporate Access

- Bureaucracy has increased with all interactions being logged

- Surprisingly, some buy-siders are reporting poor responsiveness from some IR teams

Author Archives: Phoenix Investor Relations

James Hambro & Partners LLP – London

The Hambro name has been closely associated with the investment world for more than 200 years. Founded in 2010, James Hambro & Partners LLP (JH&P) is an Independent Private Asset Management Partnership with assets under management, advice and administration of £2.8 billion (US$3.8 billion). The partnership offers institutional-quality investment management to HNW families, trusts, individuals, charities and associated portfolios.

The Hambro name has been closely associated with the investment world for more than 200 years. Founded in 2010, James Hambro & Partners LLP (JH&P) is an Independent Private Asset Management Partnership with assets under management, advice and administration of £2.8 billion (US$3.8 billion). The partnership offers institutional-quality investment management to HNW families, trusts, individuals, charities and associated portfolios.

William Francklin joined JH&P in July 2017 and has over 30 years’ experience managing portfolios. He began his career in investment management in 1981, working at Morgan Grenfell Asset Management (in both London and New York) and latterly at Waverton Investment Management. William has also managed assets for American clients for a number of years. As JH&P has SEC authorisation (as of July 2017) he will continue to manage global portfolios for US clients based in the US and overseas. Continue reading

Larry Fink (BlackRock) – letter to CEOs

Larry Fink, the founder and CEO of BlackRock has written his annual letter to the CEOs of the companies in which the world’s biggest institution owns shares. In it he urges CEOs to consider the societal implications of their business decisions and to focus on their long-term plans. “To prosper over time, every company must not only deliver financial performance, but also show how it makes a positive contribution to society. Companies must benefit all of their stakeholders, including shareholders, employees, customers, and the communities in which they operate.”

He highlights BlackRock’s responsibility to engage with companies because index investors have become the ultimate long-term investors and he reaffirms his belief that companies are overly focused on the short term.

He calls for companies to articulate their strategy for long-term growth and explain their strategic framework for long-term value creation. “This is a particularly critical moment for companies to explain their long-term plans to investors.”

The letter, available below in full, is well worth reading…

https://www.blackrock.com/corporate/en-be/investor-relations/larry-fink-ceo-letter

Royal London Asset Management – London

Royal London Asset Management (RLAM) was established in 1988 and is a wholly-owned subsidiary of the Royal London Group (founded 1861). The Group consists of the Royal London Mutual Insurance Society Limited (RLMIS) and its subsidiaries, and is the UK’s largest mutual life, pensions and investment company.

RLAM also manages assets to external clients, notably corporate pension schemes, local authorities, insurance companies, charities, endowments, universities, wealth managers etc. It has AUM of £106 billion/$140 billion (June 30 2017).

Mike Fox is Head of Equities and Senior Fund Manager of the Sustainable World Trust and Sustainable Leaders Trust, the latter role he has fulfilled since November 2003. During this time he has been awarded Citywire Top 100 UK Growth Fund Manager of the year (2007) and has a 4* Morningstar rating.

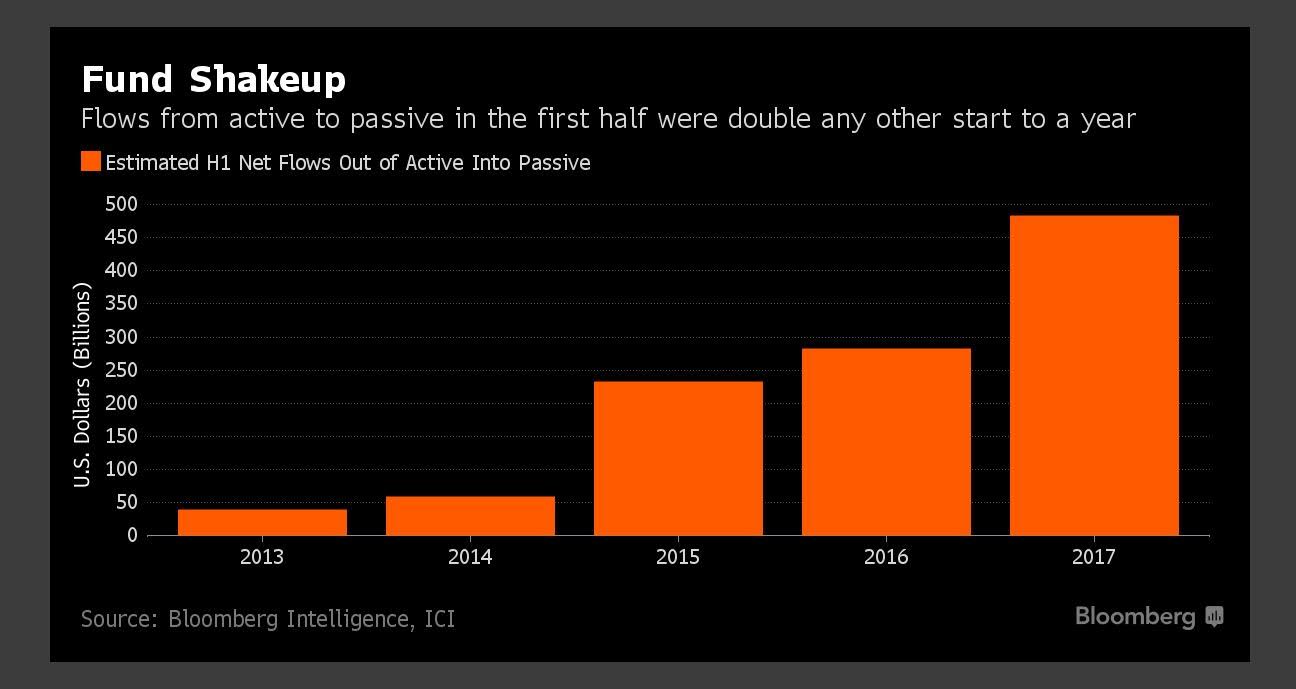

Fund Shakeup

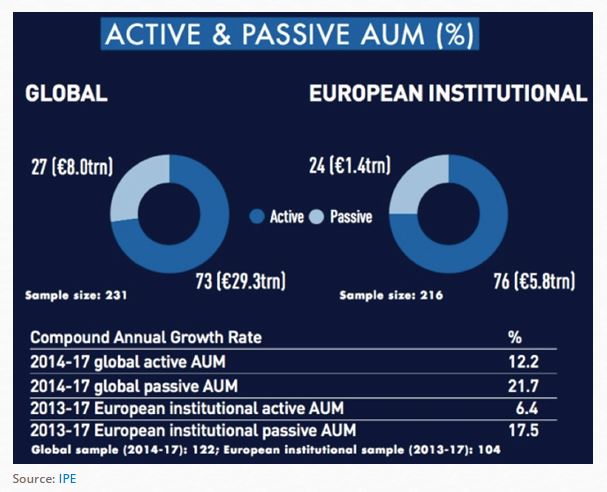

Active & Passive AUM (%)

Source: https://www.ipe.com/news/asset-managers/top-400-asset-managers-2017-global-passive-assets-hit-8trn/10019389.article

Sarasin & Partners – London

Jeremy Thomas joined Sarasin & Partners in 2016 from Allianz Global Investors where he spent 12 years. Prior to this he spent three years at Isis Asset Management (now BMO Global), five years at Schroders and five years as a British Army Officer. He has a degree in PPE from Oxford University.

joined Sarasin & Partners in 2016 from Allianz Global Investors where he spent 12 years. Prior to this he spent three years at Isis Asset Management (now BMO Global), five years at Schroders and five years as a British Army Officer. He has a degree in PPE from Oxford University.

London-based Sarasin & Partners LLP manages £14.1 billion ($18.3 billion). Local management own 46% of the economic interest of the partnership with the remaining 54% owned by Basel-based Bank J Safra Sarasin Group (AUM $154bn). Sarasin & Partners manages money for domestic and overseas private clients, charities, pension funds, institutions and retail investors.

Aviva Investors – France

Matthieu Rolin joined Aviva Investors France in 2015 and covers US equities. He was previously a senior portfolio manager at SwissLife Banque Privée (2010 – 2015) and a senior fund manager at Olympia Capital (2004 – 2010). He has a Masters in Banking and Finance from Université Lumière (Lyon II) and SKEMA Bachelor.

Matthieu Rolin joined Aviva Investors France in 2015 and covers US equities. He was previously a senior portfolio manager at SwissLife Banque Privée (2010 – 2015) and a senior fund manager at Olympia Capital (2004 – 2010). He has a Masters in Banking and Finance from Université Lumière (Lyon II) and SKEMA Bachelor.

Aviva is one of the world’s largest insurance groups with global assets of >$630 billion. It is also France’s third largest multi-line insurer and has ~$50 billion under management.

How is Aviva Investors France positioned in the French investment management industry?

“We are a top 10 asset manager in France in terms of AUM. We invest in all asset classes – equities, fixed income, real estate, multi asset and some alternative investments. There are 35 in the investment team – portfolio managers and analysts and we also share resources with other Aviva offices around the world. For example, there are nine analysts in the US, eight in London, two in Singapore and one in Toronto plus the four analysts we have in Paris.”

A Match.com for Investors to Gain Corporate Access

A group of upstarts is seizing on new European Union rules to shake up banks’ matchmaking role between investors and corporate executives.

As investors prepare for EU regulations that will force them to pay for research products a la carte, one of the most valuable services is Corporate Access — the conferences, roadshows and face time with executives that can provide an information edge. Investors globally spend more than $2 billion a year for corporate access, according to consulting firm Greenwich Associates.

That spending was typically baked in to trading commissions paid to a bank. Making it a separately priced service provides a big opportunity for people like Adrian Rusling, founder of a site that counts executives at BlackRock Inc., Credit Suisse Group AG and FedEx Corp. among its users.

“It’s like Match.com,” said Rusling, who started www.CorporateAccessNet

Planning for Europe’s MiFID II rules, which take effect in January, has driven a 50 percent surge in daily user requests so far this year, Rusling said.

Link to original story: https://www.bloomberg.com/

Phoenix-IR partners with Investor Update to reveal shareholdings behind requests for Corporate Access

April 19, 2017 07:30 AM Eastern Standard Time

LONDON, NEW YORK, PARIS & BRUSSELS –(BUSINESS WIRE)–

Phoenix-IR and Investor Update announce a partnership to offer corporate clients the ability to request and receive accurate, near real-time, and detailed investor shareholding positions through Phoenix-IR’s CorporateAccessNetwork.

CorporateAccessNetwork is a social network platform enabling direct contact between institutional investors and publicly-listed companies. This partnership with Investor Update now empowers IR teams, using the CorporateAccessNetwork, to discover shareholding positions behind each institutional meeting request. This new service will help improve transparency and foster better understanding between investors and issuers.

This shareholding intelligence goes beyond public filings information, which can be out-of-date and incomplete, and instead, leverages the power of bespoke research to provide the most up-to-date pre-meeting shareholding data and qualification available to corporates today.

The combination of Phoenix-IR’s CorporateAccessNetwork platform and Investor Update’s transparency into shareholdings gives IR teams a faster, laser-like resource for investment community engagement.

Adrian Rusling, Partner at Phoenix-IR, said “We’re delighted to add Investor Update to Phoenix-IR’s CorporateAccessNetwork.com. Public ownership data is widely available already but we can now take this to a new level by making the connection between Corporate Access interest and ownership on a near real-time basis. This adds significant value to the targeting power of the CorporateAccessNetwork platform and enriches the user experience by providing more insight for IROs. The team at Investor Update is one of the most experienced in the marketplace today and their expertise complements our drive to create a truly open global market place for Corporate Access.”

Patrick Mitchell, Co-Founder & Managing Partner, said “Phoenix-IR’s CorporateAccessNetwork is a platform based solution that enables institutional investors to connect with publicly-listed companies. With the advent of a post MiFID II world almost upon us and with management and IR time always at a premium, we are excited to offer the combination of Phoenix-IR’s established network of investors and Investor Update’s enhanced approach to precision shareholder intelligence. This will allow corporates to prioritise and direct investor outreach in an even more focused manner”.

About Investor Update

Founded by industry veterans, Patrick Mitchell and Tasos Constantinou have combined experience of over 50 years providing sophisticated products and solutions to corporate issuers and the financial community. Investor Update assist their clients in navigating the complex world of global custody and targeting and tracking key investor holdings with timeliness and pinpoint accuracy, giving a unique insight into key shareholder movements in the equity and debt markets. With offices in London and New York, Investor Update provides strategic solutions to corporates, corporate access and transactional teams, proxy solicitation firms and IR & PR agencies.

For more information visit www.investor-update.com

About Phoenix-IR

Founded in 2005, Phoenix-IR is a leading European-based investor relations consulting firm specializing in Targeting, Roadshows and Perception Research services for publicly listed companies. Phoenix-IR launched its CorporateAccessNetwork.com platform in 2013 and it has already processed more than 75,000 meeting requests from more than 1,000 institutions for 2,000 publicly listed corporations. In the new regulatory environment being shaped by the FCA and MiFID II, CorporateAccessNetwork is a smarter way for investors and companies to connect directly, using modern technology.

For more information visit www.Phoenix-IR.com and www.CorporateAccessNetwork.com

Contacts

Investor Update

Patrick Mitchell, Managing Partner

Phone: +44 20 3371 1916

Email: pmitchell@investor-update.com

Phoenix-IR

Adrian Rusling, Partner

Phone: +322 626 10 51

Email: adrian.rusling@phoenix-ir.com