Author Archives: Phoenix Investor Relations

ESMA Unveils New Rules for Research

ESMA Unveils New Rules for Research – In mid-December ESMA (European Securities and Markets Authority) issued the long-anticipated final draft of its new regulatory framework, the Markets in Financial Instruments Directive II (MiFID II).

Institutional Investor magazine provided an update on January 15, 2015 on how MiFID II might handle payments for research and Corporate Access.

Some extracts from the piece:

Specifically, ESMA calls on the sell side to separate research payments from execution fees. For the buy side, research budgets must be established in advance and made plain to clients, with each agreeing to its share of the expense before the budget is implemented.

“That will be good for the ultimate investor, but it’s probably not good over the long haul for the big sell-side firms.”

The bulge brackets’ losses, however, could be independent providers’ gains. Michael Mayhew, chairman of Integrity Research Associates: “If I’m paying this large sell-side firm $1 million for research, and that same amount will get me ten different independent firms’ research, I’m probably going to have to reconsider my budget allocations. European asset managers will likely start reducing their dependence on the large sell-side firms and increasing their reliance on independent research.”

The U.K. regulator has already banned using commissions to pay for Corporate Access, judging management introductions to be outside the realm of substantive, proprietary research. In many ways, the MiFID II draft surpasses the FCA’s strictures.

“ESMA goes further in respect of saying the buy side must have a separate payment account for all research and advisory payments, with budget approval via clients, and even clearer separation from any trading commission spending,” Kelly explains. “ESMA is also more explicit in the need for transparent pricing of research services.”

The FCA requires “hard dollars for organizing and logistics of a road show, say, but permits commissions for the analysis and reports from an analyst that go alongside it.” ESMA’s proposed regulations, however, refers to certain “minor nonmonetary benefits” that the sell side can provide without separate billing, such as conferences and seminars. “This means ESMA is saying that parts of what the FCA would define as corporate access are okay to use commissions to pay for — or at least that is how I read it,” he says. “In this regard, ESMA is going less far, as it were, than the FCA, although personally I think it less likely the FCA will change its stance on corporate access.”

The real devil will be in the details to come, for the draft doesn’t tell market participants how to implement its directives. An open hearing is scheduled for February 19 in Paris, and public comments are welcome through March 2. Then, ESMA will finalize its recommendations and send them to the European Commission for approval before year-end. The new regulations will take effect at the start of 2017.

For the full article click here.

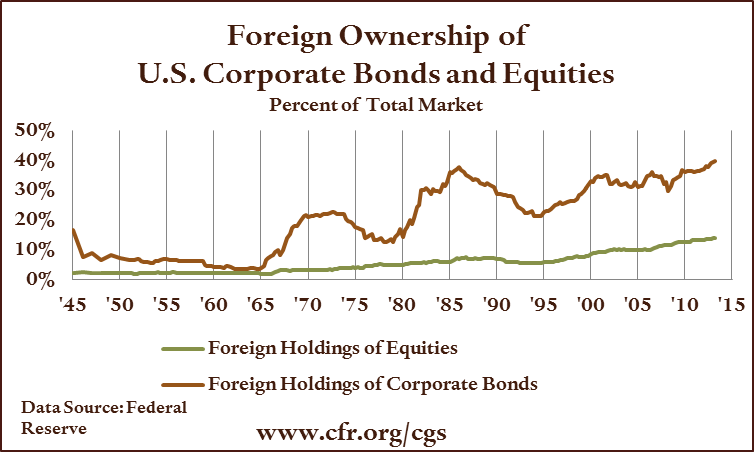

Foreign ownership of U.S. equities

- Since 1985, foreigners have consistently owned more U.S. assets than Americans own foreign assets

- International investors own approximately 15% of the U.S. equity market

- U.S. total market cap is approximately $25 trillion, so 15% = $3.75 trillion

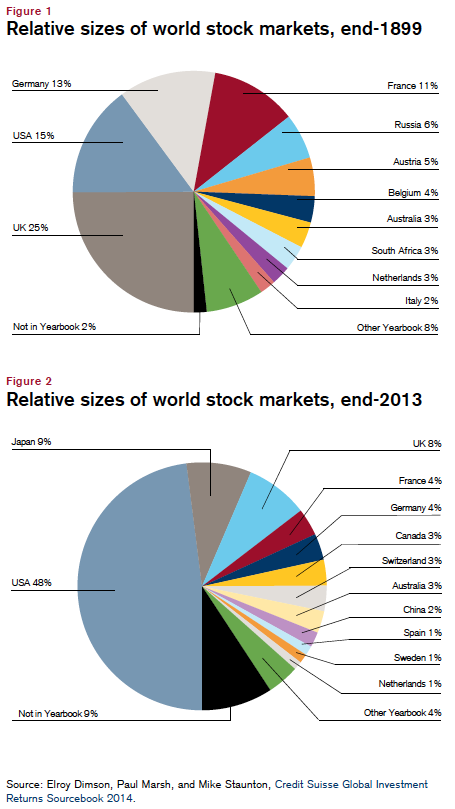

Relative sizes of world stock markets 1899 – 2013

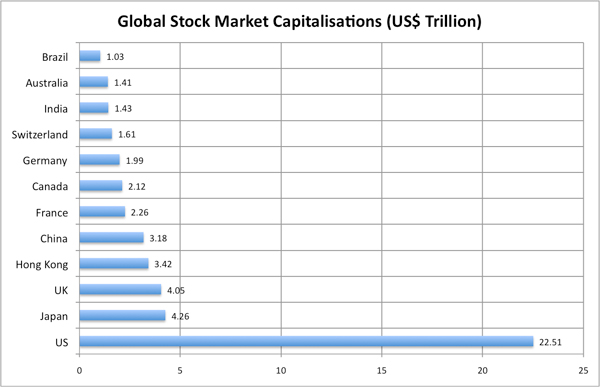

Global Stock Market Capitalisations

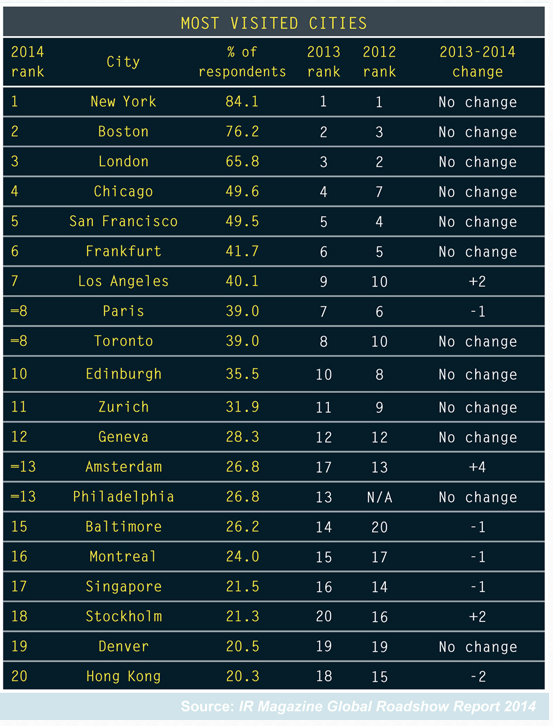

Corporate Access

On May 8, 2014 the UK’s financial regulator, the FCA published its decision confirming that investment managers can no longer use commissions to pay brokers for corporate access. These changes will take effect on June 2, 2014.

The final rules are in the document below – go to page 14 for the specific discussion on Corporate Access:

Source: FCA

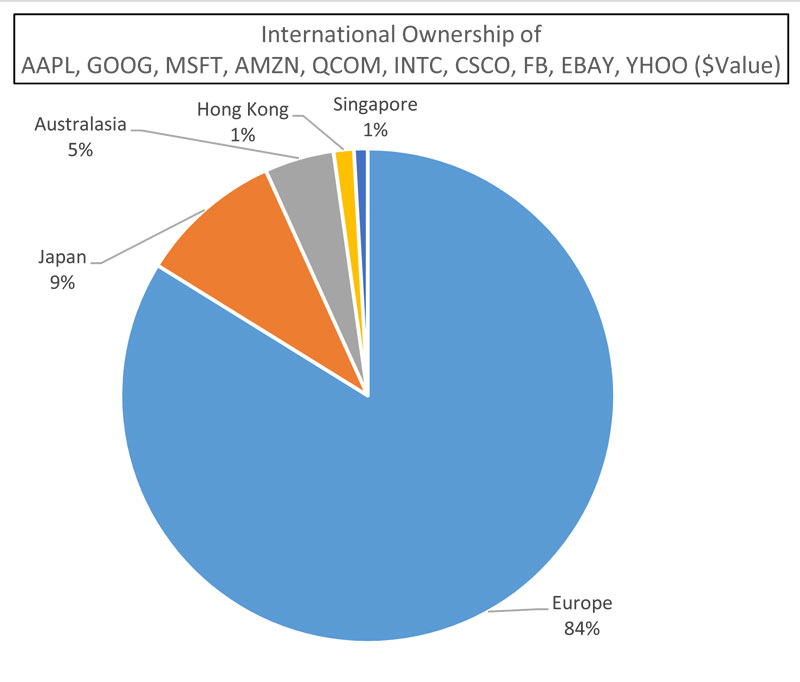

International Ownership of AAPL, GOOG, MSFT, AMZN, QCOM, INTC, CSCO, FB, EBAY, YHOO ($Value)

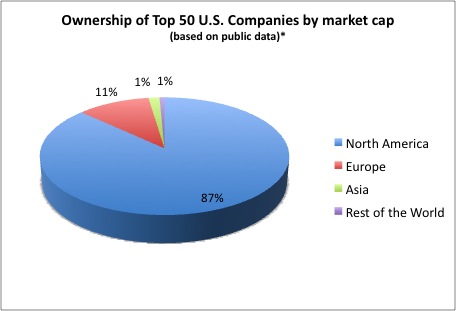

Ownership of Top 50 U.S. Companies by market cap

* Public data ex U.S. is incomplete because of poor disclosure, therefore underestimating foreign ownership

Foreign Portfolio Holdings of U.S. Securities – U.S. Treasury

Investors paying $1.25 billion for Corporate Access

The 2013 Thomson Reuters Extel survey shows that 25% of client commissions were used to reward brokers for corporate access, down from 27% in 2012. Among UK-based managers, the fall has been slightly larger, from 27% to 21% as a result of the FSA’s clampdown.

With an overall commission pot of $5 billion this suggests that $1.25 billion is being paid for Corporate Access. The FT notes that some hedge funds are paying brokers $20,000 an hour to meet CEOs.

Steve Kelly, MD of Thomson Reuters Extel, was quoted in the FT on June 9, saying the figures exposed a “’fundamental contradiction’, in that use of client commissions to pay for corporate access was now outlawed, but it remained a service many asset managers valued highly.”

The FT reported that “Mr. Kelly was adamant that asset managers were not simply flouting the edicts of the FSA and the Financial Conduct Authority, its successor body. It has been visibly clear to me that the buy-side has been reacting to what the FCA has said. They are definitely not ignoring it.”

Daniel Godfrey, chief executive of the UK Investment Management Association was quoted in the same article saying that the industry had reacted “very strongly” to the regulatory clampdown and that asset managers were not breaking the rules. “My bet is that client money is not being used to pay for corporate access in ways that are outside the definition of research. If it is straight corporate access, firms are paying for it out of their own pockets,” he said, a practice that is allowed.

Asset managers are able to use investors’ money to pay sell-side brokers for research, and Mr. Godfrey argued payments for corporate access were still permissible if they were “part of a process or part of a product that can clearly be defined as research”. Mr. Godfrey said the IMA had set up a working party to examine how research should be paid for.

However, Alan Miller, chief investment officer of SCM Private, the London-based investment manager, and a campaigner for more transparent fees is quoted as saying: “There is evidence that, following the FCA review, some companies have simply relabelled these payments as research to get around the rules.”