According to the ECB, the largest euro area insurers have been de-risking their balance sheets by reducing their exposure to equities and increasing their exposure to corporate and government bonds. What is worrying about this chart is that it only shows the change from 2007 and 2008. It will look much worse for equities when the 2009 data comes in!

Category Archives: 4) Markets

Sovereign Wealth Funds Update 2009

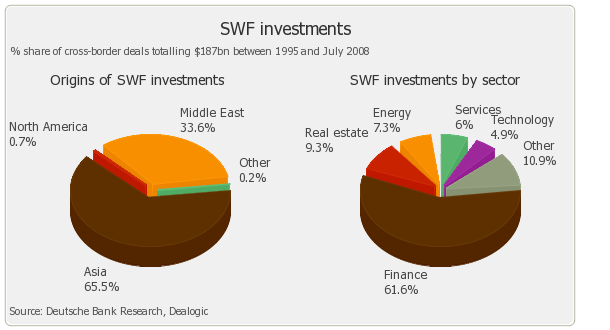

IROs are constantly asking us about interacting with SWFs (Sovereign Wealth Funds) but they also have many reservations, mainly due to the limited disclosure and poor transparency of some entities. In our role as IR consultants we frequently advise IROs on specific SWFs and facilitate access to key decision makers. In this update we’ve pulled together some recent data which we believe is interesting and worth sharing with you. If you would like to know more, please don’t hesitate to contact us directly.

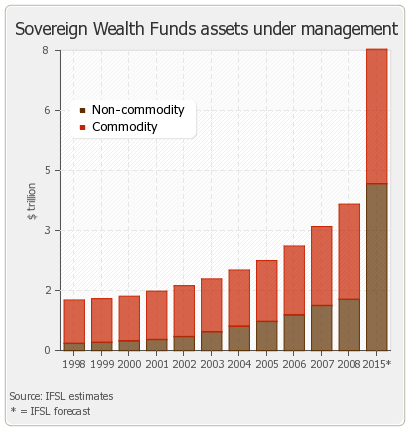

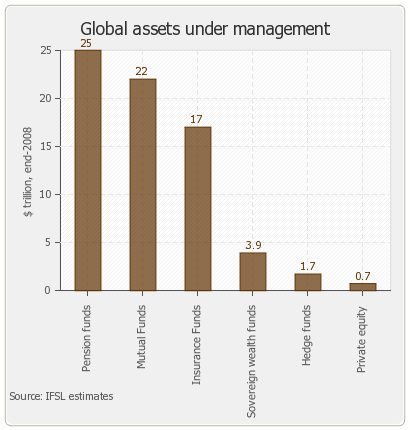

- IFSL estimates that AUM of SWFs increased by 18% in 2008 to $3.9 trillion. Huge losses on some investments were more than offset by inflows. IFSL projections are that SWFs are likely to double from their current level to around $8 trillion in 2015.

- SWFs are already significantly bigger than hedge funds.

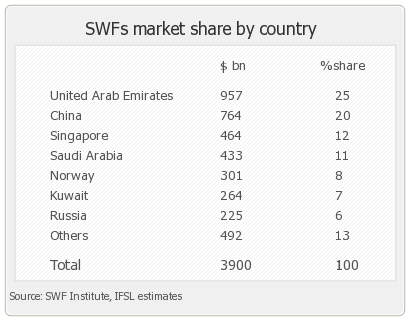

- Around 45% of SWFs come from oil rich countries in the Middle East.

- Pensions & Investments magazine estimates approx 45% of SWF assets are managed by external managers. This may decline as more SWFs develop internal capabilities and shift from passive to active strategies.

- Deutsche Bank estimates changing asset allocation could lead to an inflow of more than $1 trillion into global equity markets and $1.5 trillion into debt markets between 2008 and 2013.

- Around 80% of oil exporting SWFs are invested in overseas assets with 50% of these investments in equities, 25% in fixed income and 15% in cash. The US is the destination for more than half of these investments with around 20% destined for Europe. More recently some SWFs have been emphasizing investments in their domestic markets and Asia.

NIRI Conference – Changing role of the sell-side

I’ve just come out of a session about the changing role of the sell-side and must say how surprised I was to hear so much bashing of the sell-side. Clearly their business model is under a lot of pressure given the current environment but the sentiment in this very well attended session (standing room only) seemed to be against using the sell-side to facilitate corporate access because they no longer do a good job, don’t deliver the right investors and can’t get good feedback from PMs. One of the speakers from the buy-side said they never tell the sell-side what they think about meetings. One IRO stood up at the end of the session and said he was completely confused by the whole situation. Strangely enough, the session next door on corporate social responsibility was not as well attended as it probably should have been. What does this tell you about the issues most on everyone’s minds?

NIRI Conference – Targeting International Investors

I’ve just finished my session on international outreach. It was well attended and there were some good questions which showed people have a good grasp of targeting Europe. I was lucky enough to have two great co-speakers in Bina Thompson of Colgate-Palmolive and Jeff Smith of FedEx, both of whom have a lot of experience in Europe. If you missed the session and are interested in the presentation, you can access a copy of the slides as well as an audio recording by clicking on this link: http://www.niristream.org/c/b.cgi?s=MKT2