A pan-European survey conducted by Phoenix-IR confirms that while institutional investors value highly the provision of corporate access, they are also critical of the process because of the inherent conflicts of interest. These distort the market for access to companies. Not all investors are treated fairly – some get good access to issuers and some don’t.

Access to the management of publicly listed companies clearly favours the largest most powerful institutional investors and the most active short-term traders who are the generators of the biggest trading commissions. Medium and smaller sized institutional investors suffer, as do longer-term investors such as pension funds which do not frequently turn their portfolios.

Summary findings

This survey shows that, on average, each investor uses only 9 brokers to provide corporate access. A very low number compared to >100 brokers providing corporate access and the number of meetings taking place each day of the week.

The other key findings of this survey of professional money managers reveal that:

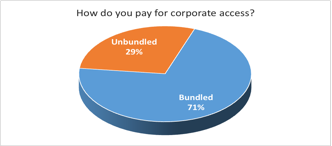

- 71% pay for corporate access indirectly through bundled dealing commissions

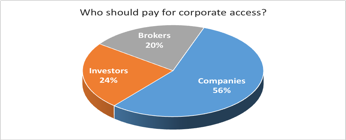

- 56% want listed companies to pay for corporate access rather than investors

- 43% believe they have been discriminated against in the provision of access

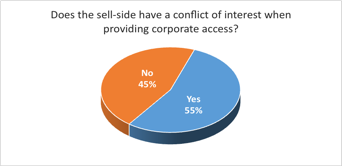

- 55% feel the sell-side has a conflict of interest when providing access

This pan-European survey was undertaken over a 10 day period from 15-25 February, 2013 and responses were received from 120 portfolio managers in: London (47 portfolio managers), Edinburgh (6), Zurich (11), Geneva (10), Paris (9), Frankfurt (8), Copenhagen (7), Brussels (5), Vienna (4), Amsterdam (4), Stockholm (4), Dublin (3), Milan (1) and Madrid (1). The total assets managed by these institutions ranges from approximately $150 million up to $500 billion with an average around $45 billion.

Background context

Following the November 2012 publication of the FSA’s “Dear CEO letter”: Conflicts of interest between asset managers and their customers: Identifying and mitigating the risks; the investor relations consultancy Phoenix-IR surveyed institutional asset managers to gain a better understanding of their views towards corporate access.

As defined by the FSA; access to company management (sometimes also referred to as ‘corporate access’) means, in this context, the practice of third parties (typically investment banks) arranging for asset managers to meet with the senior management of corporations in which the asset manager invests, or might subsequently invest, on behalf of customers.

Many large cap corporations undertake around 200 such meetings per year.

According to the Thomson Reuters Extel Survey 2012, the proportion of dealing commissions used to pay for corporate access increased to 29% in 2012, compared with 27% in 2011 and 21% in 2010.

Corporate access is now the largest component of services provided by the sell-side, overtaking trading and execution (28%) and research (26%) for the first time.

Greenwich Associates estimates that investors give $1.4 billion annually to their brokers to arrange for corporate access. Investors often pay brokers directly or indirectly $5,000-$10,000 per meeting, depending on the level of management being accessed. But a one-on-one with a marquee CEO could be worth as much as $20,000.

Detailed findings

120 portfolio managers responded to this survey answering the following questions:

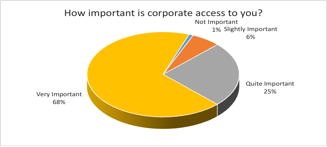

Q. How important is corporate access to you?

68% of the investors in this sample described corporate access as very important and only 7% described it as slightly important or not important. The vast majority of corporate access is provided by investment banks through non-deal roadshows or conferences. Less than 20% of corporate access is provided by other non-broking 3rd parties.

68% of the investors in this sample described corporate access as very important and only 7% described it as slightly important or not important. The vast majority of corporate access is provided by investment banks through non-deal roadshows or conferences. Less than 20% of corporate access is provided by other non-broking 3rd parties.

Q. How do you pay for corporate access?

71% of respondents report paying for corporate access indirectly through bundled dealing commissions while only 29% pay through unbundled CSAs.

71% of respondents report paying for corporate access indirectly through bundled dealing commissions while only 29% pay through unbundled CSAs.

Q. Who should pay for corporate access?

When brokers provide access, companies don’t pay; the investor does. And investors are prepared to pay large sums for access because in today’s highly regulated markets they feel meeting company management directly is one of the most important ways to gain an advantage in selecting stocks.

However, 56% of portfolio managers responding to this survey actually believe listed companies should pay for corporate access “because it is part of the cost of capital”.

Q. Do investors feel they pay too much for corporate access?

Even though most investors in this sample believe companies should pay the bill, one indication of how much value they place on corporate access is that only 14% believe they are paying too much at the moment.

Corporate access has become the single most important part of many investors’ investment process.

Q. Does the sell-side have a conflict of interest providing corporate access?

55% of investors feel the sell-side has a conflict of interest when providing access.

55% of investors feel the sell-side has a conflict of interest when providing access.

Q. Have you been discriminated against in the provision of corporate access?

57% of investors do not believe they have been discriminated against in the provision of corporate access. However, 43% feel they have been discriminated against in some way and they cite the broker’s conflict of interest as the main reason.

For example:

“Brokers always go to their highest paying clients first. I have seen this from both the positive and negative sides.”

Pension fund manager, London

“Brokers favour high frequency traders vs. fundamental investors.”

Long-term investor, London

“Brokers run tiered categories of customer. ‘Level one’ clients routinely get better access to corporates.”

Large investment management firm, London

“Funds with large AUM or good relationships with the broker are given access. Even though we may be large/significant shareholders, if we do not have a relationship with the broker, we have no way of getting access on roadshows.”

Pension fund manager, London

“Whilst our AuM is a reasonable size (c.$9bn) our turnover is low and hence we are not that attractive a client for brokers in terms of commissions. It seems that high commission clients get preferential access, in our view.”

Investment management firm, London

“Brokers give priority to larger fee generating clients.”

Investment management firm, London

“Based on your value to the broker, you may or not get a seat around the table.”

Hedge fund manager, London

“Discrimination is a function of size. Brokers give better access to largest clients.”

Investment management firm, Geneva

“After continual rude demands for increased commission from one multinational brokerage firm we stopped dealing with them after they threatened to cut us off from corporate access. We still tend to see the companies they bring around however generally only get last minute invites and only to group meetings.”

Investment management firm, Edinburgh

“The major conflict of interest for the sell-side is that their main direct financial incentive is to organize meetings with investors that generate a lot of commissions, i.e. short-term oriented investors with short holding periods, rather than long-term oriented investors that don’t trade a lot but could become long-term shareholders in companies.”

Long-term sustainability investor, London

“Corporate access is best provided by independent 3rd parties. The broker involvement muddies the waters and creates conflicts of interest and bias. The system of broker-driven access is flawed from many angles.”

Pension Fund Manager, London

“Companies need to make an effort to communicate with all interested parties and not only the larger holders of shares.”

Specialist investment manager, Edinburgh

“Companies should be more aggressive with investment banks when poorly informed hedge fund investors are given meetings in preference to well informed longer term investors.”

Leading investment management firm, London

“I am always surprised – but effectively positively – if a company uses an external corporation to get in contact with us as investors as it seems to be more independent.”

Investment Management firm, Frankfurt