David Shaw is co-head of global equities at AXA Investment Management. He also manages the Global Sustainable Distribution Fund, co-manages the Global Sustainable Managed Fund and is deputy on the American Growth fund. He joined AXA in 2016 from Aerion Fund Management (2000-2016). Before this he worked at NPI, NatWest Investment Management and United Friendly Asset Management. He was educated at City University and has a BSc (Hons), Electronic Engineering.

David Shaw is co-head of global equities at AXA Investment Management. He also manages the Global Sustainable Distribution Fund, co-manages the Global Sustainable Managed Fund and is deputy on the American Growth fund. He joined AXA in 2016 from Aerion Fund Management (2000-2016). Before this he worked at NPI, NatWest Investment Management and United Friendly Asset Management. He was educated at City University and has a BSc (Hons), Electronic Engineering.

AXA IM is part of France’s AXA Group, a global leader in insurance and asset management with AUM of $916 billion. AXA IM traces its roots back to 1994 and today is present in 22 offices in 18 countries. The firm is an active, long-term, global, multi-asset investor. AXA’s primary equity management operations are Paris and London. The London office runs a number of global equity funds including a number of thematic and geographic funds.

Equity AUM in London and Paris?

$61 billion in equities.

What’s the equity AUM figure for London?

$36 billion.

How do London and Paris co-operate?

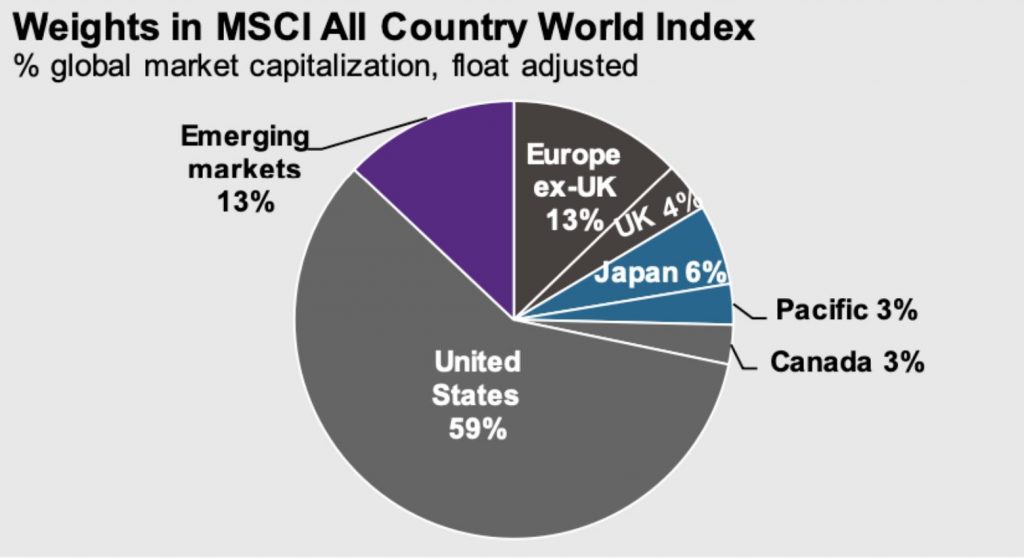

Paris is predominantly European equities, the global small cap team, the convertibles team and the multi-asset team. London manages sector specific funds such as technology, healthcare, Thematic and regional funds such as The American Growth Fund as well as a number of global funds. Many of the sector specialist fund are quite US-centric given their technology/healthcare skew. If you note that >60% of the MSCI is US, then we have higher exposure to US equities. But I wouldn’t want to put people off visiting Paris. We do collaborate and often share ideas with the global small cap team in Paris, for example.

In terms of collaboration, we have two formal meetings a week – one with a regional focus and the other is more thematic/sector specific. Teams from London, Paris and Hong Kong share thoughts. We do a good job of getting the London and Paris teams to collaborate. Names from the American Growth may also be held in the global small cap fund.

Which screens do you use?

Fund managers have a lot of personal autonomy. We tend to look for quality growth. Some strategies are more GARP while others are out and out growth. (We hold a few names that are still unprofitable but working towards it, companies with innovative, breakthrough technologies).

Do you use benchmarks?

Yes – most strategies have an appropriate benchmark. We are benchmark aware, not benchmark driven.

Active share?

Most portfolios hold 40-60 stocks, so our active share ranges between 60 – 70% dependent on the fund.

Minimum market cap?

Around $1 billion – Small cap team would be lower.

Average position size and largest?

Largest – we would have exposure to Apple even if it is underweight for our US funds. So that would be our largest holding without being an active bet. A typical active weight is 100 BP above the benchmark.

Average length of a holding?

4-5 years+. A couple of names in my US portfolio we’ve held for 6 – 7 years. We buy and hold where companies are executing well. We want to be long term investors, and invest in companies that grow and develop. However, fund managers may trade around a position so will trim if sentiment is overly optimistic.

Geographic allocation?

>60% in US. A lot of the global/specialist strategies are heavily exposed to the US e.g. our healthcare and technology funds.

Sector allocation?

We pay attention to sector allocation but look for good organic innovative, growth names. Some sectors such as healthcare, technology and consumer discretionary in the US are good places for innovation and new ideas. Sectors where you don’t see much innovation and growth are, for example, financials, utilities and energy and we are typically underweight these sectors.

How does the team split sectors and geographies?

We do have our technology and healthcare specialists, but fund managers are attracted to certain sectors by the nature of their investment style. Steve Kelly and I tend to focus our attention on Healthcare, Technology and Consumer.

61% of assets are ESG integrated, how is ESG integrated into the investment process?

We have a large Responsible Investment team (more than 30 people) which supports the whole business, not just equities. In addition, there is a team of 7 ESG & Impact analysts who work more closely with the equity team. We have an Impact Fund range as well as dedicated ESG funds (our ACT range). The sustainable funds that I’m involved in all have a high degree of ESG integration. The sustainable funds look for companies that can deliver sustainable opportunities including environmental or social progress. As growth investors, we are looking for businesses of the future and they normally align well with ESG. Younger businesses take those responsibilities more seriously.

Discuss some holdings and why you invested?

Mondelez – bought it for my US funds in 2016 and still hold it. The weighting has increased as my confidence in the growth dynamics and management has grown over time. When I first bought it, I didn’t have much exposure to consumer staples. It was one of the better food producers, with faster growing categories. It was growing slower than its overall category due to a focus on margins that was stifling growth. The management transition of 2018 has gone well, and Dirk and Luca were very early in transitioning from a cost focus to looking for more

growth. They also moved away from the traditional US centralised Chicago HQ to a more decentralised localised management style where local offices have a say on sales’ strategies and product development. So, growth is now in line, and they have managed to keep within their margin framework.

Food producers can face challenges and our Responsible Investment (RI) team have been a huge help in this regard. We, as a firm, wanted to learn more about deforestation and so our RI team had a meeting with Mondelez about how they ensure their suppliers are not involved in deforestation. Overall we felt that Mondelez are ahead of their peers. While we would like them to do more, it is good to have the back up of RI team and they came away with good outcome from their engagement.

NextEra – the only US utility that we own. We own it in our global portfolios, as well as some US funds. They are forward thinking, and it has delivered the best organic growth amongst US utilities, partly due to its innovative early adoption of renewable energy. And being based in Florida helps (population growth). NextEra has more organic growth than most US utilities. It is also very well positioned due to its renewables exposure in terms of ESG. Their target is “real zero” – by 2045 – 100% renewable energy generation – and they are well on way to achieving it.

Chipotle – My colleague, Steve Kelly, first invested over a decade ago for the American Growth Fund. It has a combination of organic growth via new store expansion and menu innovation. (It has a simple menu so it can add in one or two new ideas). It has some of the best unit dynamics in the quick service industry in US. Covid gave them the opportunity to develop their digital offering – on-line or take away and they’ve been very successful there. 2023 sales are forecast to be 80% higher than in 2019. So, they have managed to grow very strongly for last 3 – 4 years and there are still some things they can do better. Productivity is probably not as high as should be as they have a number of new hires who take time to get faster at making burritos, for example.

Dexcom – another >10 year holding. Great example of a holding that started with one team and other teams have become interested. It started out as a holding in the American Growth Fund, and it is now widely held on our Thematic funds, our healthcare funds, Global funds and the convertible team owns the convertible. So cross pollination of ideas leads to more teams owning it. Holdings of names that execute on the long term growth strategy, do snowball as fund managers hear the story, and it becomes a major holding across the firm. Dexcom is

the creator of the continuous glucose monitoring industry. Innovation keeps coming, making the product smaller, making the sensor last longer etc. It improves health outcomes and users are big fans.

Chart Industries – a newer name we recently added. I met the company properly in November 2021. The business has changed in recent years. Their core business and expertise are in gas compression and liquification technology. In the last 3-4 years, management has transitioned the business away from the legacy LNG business and is growing in hydrogen, biomass, carbon capture and storage. So, from fossils fuels to fuels of the future. We originally added it to the US funds and now it is in convertibles and global small caps as well as we’ve spoken to other teams about it.

Do you like to meet management?

Yes, but it can be hard work to carve out time to prepare for a meeting and we do like to do our homework. We like to check market expectations, and gain comfort from management as we are looking to be long term holders. We want a company to meet/exceed long term guidance. We want to understand what levers a company has if things don’t go as expected.

Preferred method of meeting management?

1/1s generally – with a popular name you could have 4-5 PMs joining the meeting from Axa IM. Group meetings can be productive though as sometimes another investor takes a different angle that you hadn’t appreciated. We prefer face to face meetings if possible. And we like companies to be consistent. It is frustrating if a company comes over and starts to build interest and then don’t come back. Year 1 our US specialist may see it, year 2 – a chance to get the company in front of a few more colleagues. Just because we are an existing holder, it doesn’t

mean the position couldn’t be increased (by other funds internally).

Any companies that stand out as particularly good at IR and why?

Tractor Supply stands out, it’s a fairly recent addition to both my GARP US portfolio and the Global Sustainable Fund. They are good at explaining the business mix and the cyclicality. Mary Winn Pilkington (Investor Relations) does a good job of explaining the different parts of the business and management are quite forthcoming.

Brunswick – we like how IR tries to frame the business. Some look at its history and how it performed during the Global Financial Crisis, but the business is now very different as the growth in Mercury engines business has reduced its cyclicality. They’ve downsized the pure boat business so that is now only 30% of revenues. Engines and accessories are the lion’s share and is more a repeat business so less cyclical.

Why should companies meet you?

We are genuinely long term and positions can be increased across numerous funds, even convertibles.

What are the major changes you’ve seen during your tenure in investment management?

Information flow has increased massively – in both detail and complexity. However, the fundamentals remain the same – if you buy a company with good organic, innovative ideas you tend to get rewarded. And you have to keep evolving and building on skills learned elsewhere.

This interview appeared in the recent digital edition of IR Magazine

Dani Saurymper is the Portfolio Manager in Pacific’s Longevity and Social Change team. Prior to joining PAM in July 2021, Dani worked at AXA where he was Portfolio Manager of the AXA Framlington Longevity Economy fund. He was also Portfolio Manager of the AXA Framlington Health Fund and research lead for Health, Ageing & Lifestyle at AXA Framlington. Dani has over 20 years experience in the Healthcare sector.

Dani Saurymper is the Portfolio Manager in Pacific’s Longevity and Social Change team. Prior to joining PAM in July 2021, Dani worked at AXA where he was Portfolio Manager of the AXA Framlington Longevity Economy fund. He was also Portfolio Manager of the AXA Framlington Health Fund and research lead for Health, Ageing & Lifestyle at AXA Framlington. Dani has over 20 years experience in the Healthcare sector. Julia Varesko is a Senior Analyst in Pacific’s Longevity and Social Change Team. Prior to joining PAM in September 2021, Julia was a senior analyst covering diversified financials at JP Morgan. She has also held roles at Elsworthy Capital and Berenberg Bank as well as a prior period at JP Morgan where she spent six years covering the Capital Goods sector. Julia is a CFA Charterholder and holds an MSc in Accounting and Finance from the London School of Economics and a BSc in Economics from University College London.

Julia Varesko is a Senior Analyst in Pacific’s Longevity and Social Change Team. Prior to joining PAM in September 2021, Julia was a senior analyst covering diversified financials at JP Morgan. She has also held roles at Elsworthy Capital and Berenberg Bank as well as a prior period at JP Morgan where she spent six years covering the Capital Goods sector. Julia is a CFA Charterholder and holds an MSc in Accounting and Finance from the London School of Economics and a BSc in Economics from University College London. Robeco is one of Europe’s largest asset managers with more than $200 bn in assets under management. Founded in 1929, just weeks after the Wall Street Crash, by seven Rotterdam businessmen who formed a syndicate to invest people’s savings and manage money collectively, it was called the Rotterdamsch Beleggings Consortium, later shortened to Robeco.

Robeco is one of Europe’s largest asset managers with more than $200 bn in assets under management. Founded in 1929, just weeks after the Wall Street Crash, by seven Rotterdam businessmen who formed a syndicate to invest people’s savings and manage money collectively, it was called the Rotterdamsch Beleggings Consortium, later shortened to Robeco. Roberto Magnatantini joined DECALIA in 2020. He is lead portfolio manager of DECALIA Silver Generation and DECALIA Eternity funds. Before joining DECALIA, Roberto was Head of Global Equities at SYZ Asset Management, where he spent 12 years managing two strategies for the OYSTER funds’ franchise. Before that, he worked four years at Lombard Odier and four years at HSBC where he managed equity funds. He is a CFA and CMT charter holder and holds a ESG certification from PRI.

Roberto Magnatantini joined DECALIA in 2020. He is lead portfolio manager of DECALIA Silver Generation and DECALIA Eternity funds. Before joining DECALIA, Roberto was Head of Global Equities at SYZ Asset Management, where he spent 12 years managing two strategies for the OYSTER funds’ franchise. Before that, he worked four years at Lombard Odier and four years at HSBC where he managed equity funds. He is a CFA and CMT charter holder and holds a ESG certification from PRI. Klaus Ingemann, co-CIO, joined AB in 2014 as Portfolio Manager and Senior Research Analyst and was promoted to Co-Chief Investment Officer of Global Core Equity in 2018. He previously served as an executive member of the investment board at CPH Capital, which he co-founded in 2011. Prior to that, Klaus was chief portfolio manager and a member of the investment board at BankInvest. He previously worked as a corporate finance advisor for Carnegie Bank and before that, spent four years in the finance department at Tele Danmark. He holds a BSc in business administration and an MSc in finance and accounting from the Copenhagen Business School and is a CFA charterholder.

Klaus Ingemann, co-CIO, joined AB in 2014 as Portfolio Manager and Senior Research Analyst and was promoted to Co-Chief Investment Officer of Global Core Equity in 2018. He previously served as an executive member of the investment board at CPH Capital, which he co-founded in 2011. Prior to that, Klaus was chief portfolio manager and a member of the investment board at BankInvest. He previously worked as a corporate finance advisor for Carnegie Bank and before that, spent four years in the finance department at Tele Danmark. He holds a BSc in business administration and an MSc in finance and accounting from the Copenhagen Business School and is a CFA charterholder. Hubert Goyé founded Graphene Investments in 2016. He used to manage flagship funds at BNP Paribas Asset Management and was head of the international equity management division (since 1996). From 1990 – 1996, Hubert worked as head of index management and as specialist on quantitative techniques and development of a selection model for American stocks. He received his degree from the Ecole Nationale des Ponts & Chaussées.

Hubert Goyé founded Graphene Investments in 2016. He used to manage flagship funds at BNP Paribas Asset Management and was head of the international equity management division (since 1996). From 1990 – 1996, Hubert worked as head of index management and as specialist on quantitative techniques and development of a selection model for American stocks. He received his degree from the Ecole Nationale des Ponts & Chaussées.