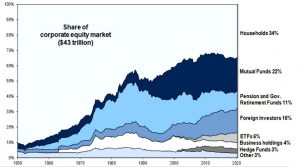

Overseas investors, who own 16% of the U.S. corporate equity market, bought $187 billion of shares during the three months through March, making them the biggest buyers of U.S. stocks during the first quarter of the year. Net corporate holdings increased by $129 billion and household purchases, including hedge funds, rose by $7 billion while pension funds and mutual funds sold a net $119 billion and $66 billion, respectively.

“Foreign investors will continue to be net buyers of U.S. stocks this year and will replace corporations as the largest source of equity demand (+$300 billion),” according to Goldman Sachs’ Portfolio Strategy Research team led by David Kostin. Goldman Sachs predicts net corporate equity demand will drop by 80% in 2020 to $100 billion as buybacks are suspended.

Source: Federal Reserve Board and Goldman Sachs Global Investment Research